Financial services highlights

07/December/2025 21:54

Share:

Below is a complete, detailed, exam-oriented, and well-structured write-up on Management of Financial Services, covering all the topics you mentioned: financial system, financial markets, financial management, risks, stock market, merchant banking, management of issue of shares and bonds, leasing, hire purchase, credit rating, banking, insurance, venture capital, and other financial services.

You can directly use this for assignments, projects, exams, or notes.

---

⭐ MANAGEMENT OF FINANCIAL SERVICES – DETAILED TOPIC HIGHLIGHTS

---

? INTRODUCTION TO MANAGEMENT OF FINANCIAL SERVICES

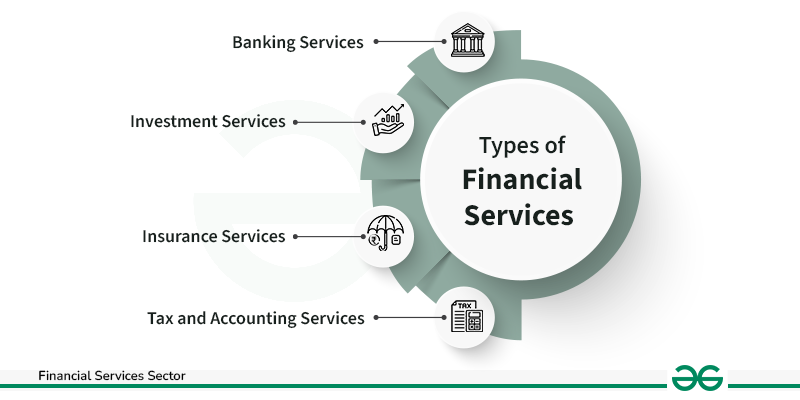

Financial services refer to all economic activities that facilitate the creation, management, and exchange of financial assets.

They include banking, insurance, investment services, mutual funds, credit rating, venture capital, leasing, hire purchase, and many more.

Management of Financial Services deals with planning, organizing, directing, and controlling these services to ensure smooth functioning of the financial system and financial markets.

It helps in:

✔ efficient mobilization of funds

✔ investment decisions

✔ risk reduction

✔ economic growth and development

---

⭐ 1. FINANCIAL SYSTEM

A financial system is a network of institutions, markets, instruments, and services that enable the flow of funds.

Components:

1. Financial Institutions – Banks, NBFCs, insurance companies, mutual funds.

2. Financial Markets – Capital market, money market, forex market.

3. Financial Instruments – Shares, bonds, debentures, derivatives.

4. Financial Services – Leasing, hire purchase, venture capital, credit rating.

Functions:

Mobilizing savings

Allocating resources

Facilitating payments

Managing risks

Governing financial transactions

---

⭐ 2. FINANCIAL MARKETS

Financial markets enable the purchase and sale of financial instruments.

Types:

A. Capital Market

Long-term funds (shares, debentures).

Includes Primary Market and Secondary Market.

B. Money Market

Short-term funds (treasury bills, commercial papers).

C. Forex Market

Deals in foreign currency and exchange rates.

D. Derivatives Market

Options, futures, swaps.

---

⭐ 3. FINANCIAL MANAGEMENT IN SERVICES

Financial management in service organizations focuses on:

Fund planning and allocation

Capital structure management

Costing of financial products

Managing receivables and liabilities

Ensuring liquidity and solvency

Profitability management

Examples:

Banks handle loan portfolio management; insurance companies manage premium investment; mutual funds manage investor wealth.

---

⭐ 4. RISK IN FINANCIAL SERVICES

Risk management is essential because financial services involve uncertainty.

Types of Risks:

1. Credit Risk – Borrower may default.

2. Market Risk – Stock prices or interest rates may fluctuate.

3. Operational Risk – Failures in systems or processes.

4. Liquidity Risk – Inability to convert assets into cash.

5. Legal and Compliance Risk – Regulatory violations.

6. Interest Rate Risk – Rise or fall in interest rates affects returns.

Financial institutions use:

✔ hedging

✔ diversification

✔ insurance

✔ risk rating

✔ internal control systems

---

⭐ 5. STOCK MARKET

The stock market is where shares and securities are bought and sold.

Functions:

Helps companies raise capital

Provides liquidity to investors

Price discovery

Encourages savings and investment

Facilitates economic development

Key Participants:

Investors, brokers, stock exchanges (NSE, BSE), SEBI regulators, listed companies.

---

⭐ 6. MERCHANT BANKING SERVICES

Merchant banks provide specialized financial services, especially for corporate clients.

Services Provided:

Management of public issues

Corporate restructuring

Project counseling

Portfolio management

Loan syndication

Mergers and acquisitions advisory

Merchant bankers play a crucial role in IPOs, FPOs, rights issues, and debenture issue management.

---

⭐ 7. MANAGEMENT OF ISSUE OF SHARES AND BONDS

This is a key financial service where merchant bankers manage the entire process of raising capital.

Stages:

1. Preparation of Prospectus

2. Obtaining SEBI approval

3. Appointment of underwriters

4. Marketing of the issue

5. Receiving applications

6. Allotment of shares/bonds

7. Listing on stock exchanges

This ensures transparency, investor protection, and successful capital mobilization.

---

⭐ 8. LEASING

A lease is a contract where the owner of an asset (lessor) gives the right to use it to the user (lessee) for a fixed period in exchange for payments.

Types of Leasing:

Operating Lease

Financial Lease

Sale and Leaseback

Leveraged Lease

Advantages:

No need for heavy upfront investment

Tax benefits

Flexible financing method

---

⭐ 9. HIRE PURCHASE

A hire purchase agreement allows the user to hire an asset by paying installments and owning it after the final payment.

Features:

Ownership transfers after final payment

Useful for vehicles, machinery

Higher cost due to interest

Participants:

Hirer

Owner (finance company)

---

⭐ 10. CREDIT RATING

Credit rating agencies assess the creditworthiness of companies and government bodies.

Functions:

Evaluate default risk

Provide ratings like AAA, AA, BBB

Help investors make informed decisions

Rating Agencies in India:

CRISIL

ICRA

CARE

India Ratings

---

⭐ 11. BANKING SERVICES

Banks play a central role in the financial system.

Key Banking Services:

Accepting deposits

Providing loans and advances

Payment and settlement services

Digital banking (UPI, Internet banking)

Forex services

Investment advisory

---

⭐ 12. INSURANCE SERVICES

Insurance companies provide risk coverage by collecting premiums.

Types:

Life Insurance – LIC, HDFC Life

General Insurance – Motor, health, property

Reinsurance – Risk sharing among insurers

Functions:

Risk transfer

Financial stability

Investment of funds

Support to economic growth

---

⭐ 13. VENTURE CAPITAL

Venture capitalists invest in high-risk, high-growth startups.

Stages of Venture Capital:

1. Seed capital

2. Early stage financing

3. Expansion financing

Characteristics:

High risk

High return potential

Active involvement in management

Venture capital is crucial for innovation, entrepreneurship, and technological growth.

---

⭐ 14. OTHER FINANCIAL SERVICES

A. Factoring

Sale of receivables to financial institutions for quick cash.

B. Forfaiting

Purchase of international trade receivables.

C. Mutual Funds

Pooling of investor funds and investing in diversified securities.

D. Derivative Services

Options, futures trading.

E. Housing Finance

Loans for homes by HDFC, LIC Housing Finance.

F. Microfinance

Small loans to rural and low-income customers.

---

⭐ CONCLUSION

The management of financial services plays a vital role in the functioning of the economy.

It ensures the efficient flow of funds, reduces financial risks, supports business expansion, and strengthens the financial system.

With the growth of technology, digital payments, fintech, and globalization, financial services have become more dynamic, competitive, and essential.